An Introduction to Treasury Inflation Protected Securities (TIPS)

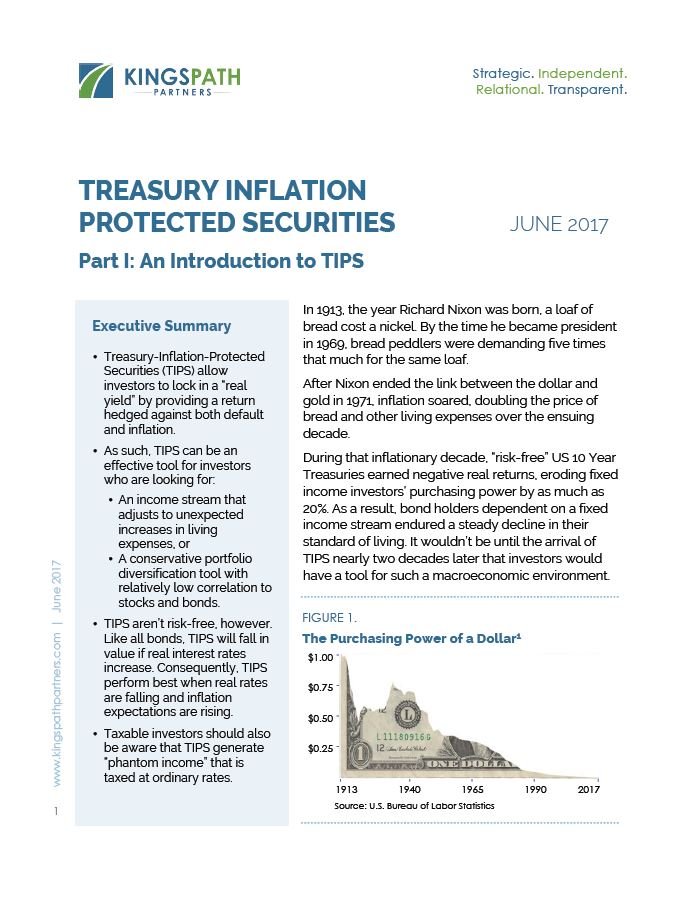

In 1913, the year Richard Nixon was born, a loaf of bread cost a nickel. By the time he became president in 1969, bread peddlers were demanding five times that much for the same loaf. After Nixon ended the link between the dollar and gold in 1971, inflation soared, doubling the price of bread and other living expenses over the ensuing decade. During that inflationary decade, “risk-free” US 10 Year Treasuries earned negative real returns, eroding fixed income investors’ purchasing power by as much as 20%. As a result, bondholders dependent on a fixed income stream endured a steady decline in their standard of living. It wouldn’t be until the US Treasury began issuing Treasury Inflation-Protected Securities, or TIPS, nearly two decades later that investors would have a tool for such a macroeconomic environment.

Download our free Intro to TIPS White Paper below to learn more.