The Evolution of ETFs

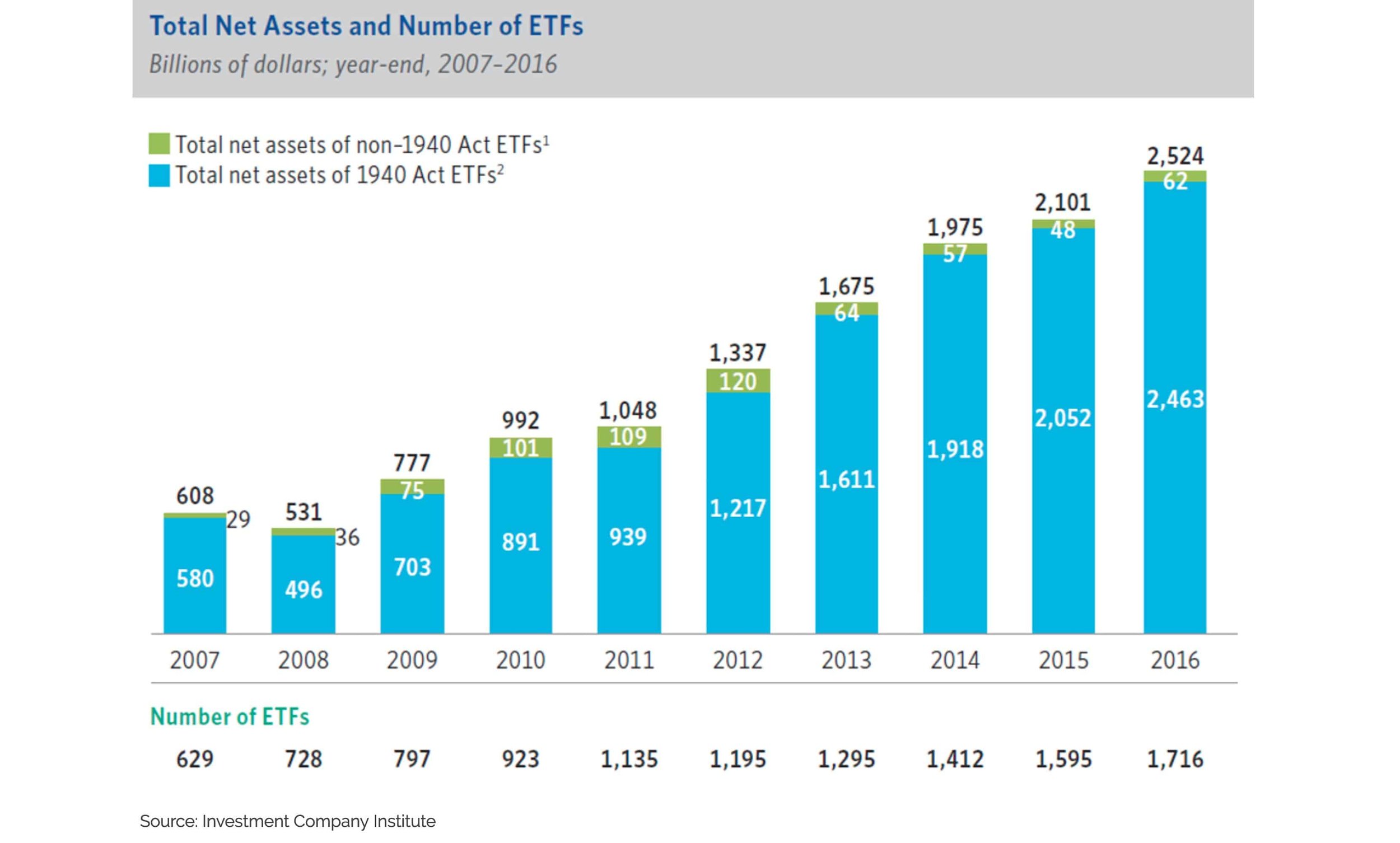

Over the past 25 years, the growth of Exchange Trade Funds, or ETFs, has arguably been the most influential trend in the investment industry. In the US, this movement started with the launch of a simple S&P 500 Index tracker (SPY) in 1993. Since then, the industry has grown to over 2,000 ETF products with nearly $2.8 trillion in assets. While still smaller than the market for mutual funds, ETFs continue to gain ground at an impressive pace, spurred on by relatively low cost, tax-efficient access to a myriad of asset classes. However, in our view, many of the products now being introduced are simply an asset grab by investment providers seeking to prey on the harmful behavioral biases of investors.

Phase One: The Good

When ETFs hit the market, their value proposition was clear: diversified exposure to core asset classes with low cost and tax efficiency. The initial crop of ETFs gained traction in both the retail and institutional market because they enabled investors to access “beta” with greater efficiency than comparable mutual funds. Initially, the industry focused on well-known indices (e.g. S&P 500) or commodity baskets (e.g. Gold). During this first phase of growth, these advantages drove the number of ETFs to just over 100 by 2001.

Phase Two: The Great

As ETFs become a more accepted investment vehicle, growth and competition increased. The biggest players (Blackrock, State Street, Vanguard) increased their ETF offerings (e.g. emerging markets and treasury-inflation protection) and regularly lowered their prices to gain market share. We also saw more innovation and the introduction of such ideas as “smart beta” ETFs and active ETFs. “Smart beta” ETFs provide an efficient way to access investment factors, such as value, momentum, quality, and dividend yield, that seek to improve upon pure index products. Active ETFs look to lower costs and improve tax efficiency relative to traditional mutual funds without being constrained to passive approaches. The number of ETFs continued to grow surpassing 1000 by end of 2009.

Phase Three: The God-Awful?

What had been a focus on winning market share through lower-cost ETFs (great for investors) is now at risk of becoming a game of gaining assets by selling “sizzle” and risky products (god-awful for investors). Whereas ETFs are easy to create, market, and trade, ETF product companies are eager to exploit our poor behavior in the name of gaining assets. Does anyone really need a 3x Bull or Bear fund? Or exposure to a basket of Qatari stocks? Or Japanese health care (currency hedged?)? These narrowly focused ETFs often entice investors into unknown risks with very clever marketing of recent past performance... much like mutual fund companies have done for years with their star ratings.

Studies have shown that investors generally don’t diversify or manage portfolios properly. We let emotions disrupt rational investment plans. We are enticed by recent returns and tend to chase performance. These ETF product firms know this and seek to exploit these behavioral biases by offering plenty of new ETF rope to hang ourselves with.

At Kings Path Partners, we utilize broad-based, low-cost ETFs for exposure to targeted markets, asset classes, or investment factors. We are long-term investors. We do not time the market and we follow an investment policy that is based on statistical design and systematic (unemotional) implementation. Any ETFs that offer “quick wins” or lack significant diversification, will not find a welcome reception in our offices.