The Surprise of the Federal Funds Rate

Each year, we publish an annual review of how well (actually, how poorly) the economists at the major banks forecast the US markets for the upcoming year (see our blog, “Forecasting Follies”). These are the “experts” yet every year they show how hard it is to predict markets over the short term.

What about the Federal Reserve Bank? Aren’t they at the top of the world of banking and economic forecasting? After all, they have access to all the data and the brightest minds.

As you will see below, over the last year their forecasts have been outright horrible, and the markets have responded accordingly.

What is the Federal Reserve?

The U.S. central banking system—the Federal Reserve, or the Fed—is the most powerful economic institution in the United States, perhaps the world. Its core responsibilities include setting interest rates, managing the money supply, and regulating financial markets. It also acts as a lender of last resort during periods of economic crisis.

The Federal Open Market Committee (FOMC) is the board that reviews economic data and sets the “federal funds rate,” which is the interest rate that depository institutions lend to other depository institutions overnight on an uncollateralized basis. This rate is one of the most important interest rates in the US economy. The theory: when the FOMC wants to slow the economy or inflation, they raise rates. By doing so, it becomes more costly for banks to lend and thus slows the availability of money and the economy. If the Fed wants to stimulate the economy, they lower rates in hopes of causing the opposite effect.

As the US inflation rate continues to rise at over 8%, we are experiencing a period of increasing federal fund interest rates in an attempt to slow the US economy and reduce inflation. As you can see below, rates have risen from near zero to over 3% in a rather short time. And more interest rate hikes are forecasted. Current forecasts are for 4.5% to 4.75% by the end of the year.

In the context of history, 4% is not something to cause too much concern. In fact, since 1954 more than half the time, the rate has been higher than 4%. It is the rate of change and the surprise of change that have really hit the markets hard.

Fed Funds Rate 2022

Who is the FOMC?

The Federal Open Market Committee (FOMC) consists of twelve members - the seven members of the Board of Governors of the Federal Reserve System; the president of the Federal Reserve Bank of New York; and four of the remaining eleven Reserve Bank presidents.

The FOMC holds eight regularly scheduled meetings per year. At these meetings, the Committee reviews economic and financial conditions, determines the appropriate stance of monetary policy, and assesses the risks to its long-run goals of price stability and sustainable economic growth.

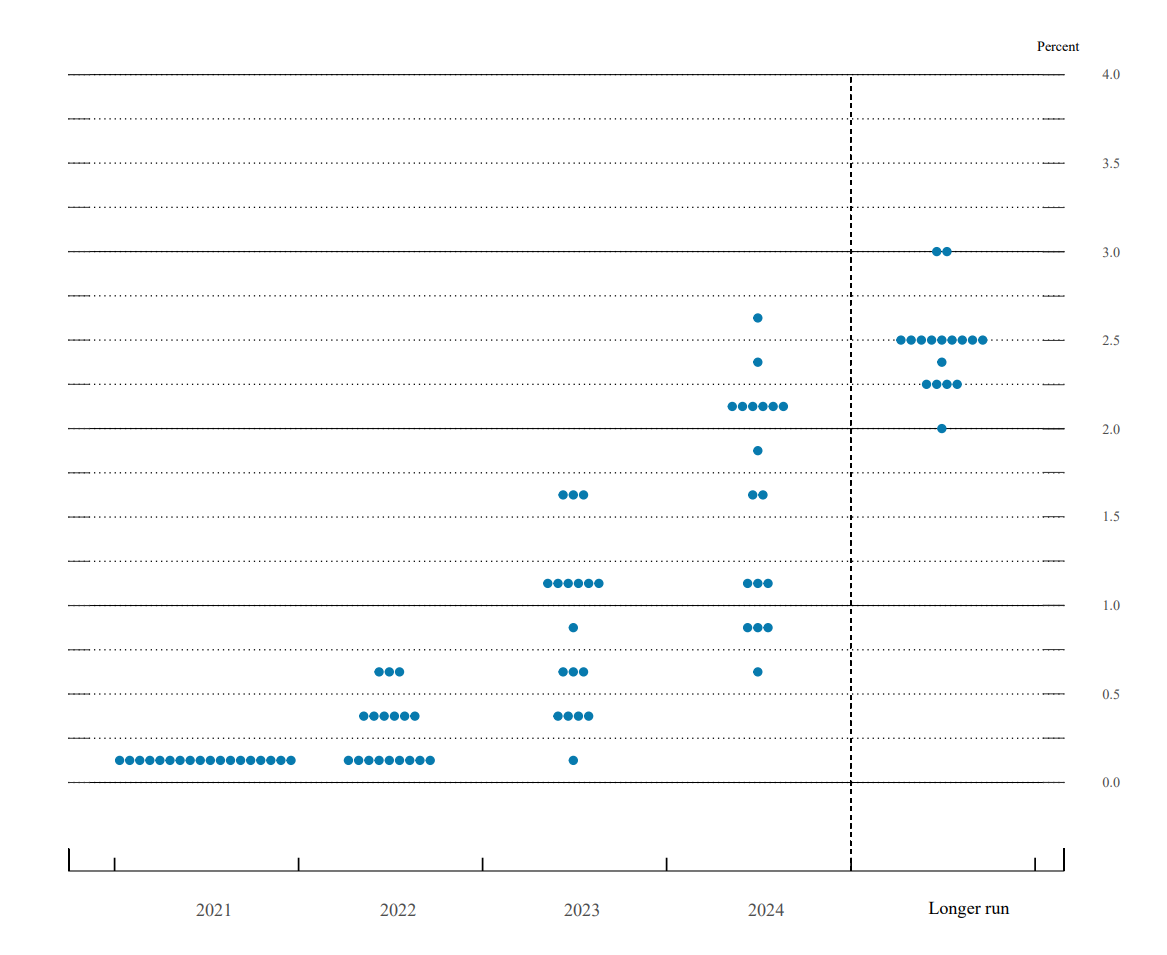

At each meeting, the FOMC creates an outlook for the Fed Funds rate called the “Dot Plot.” Each member places dots denoting their projection for future interest rates in subsequent years. This Dot Plot is highly discussed and sets the market’s expectations for future rate increases.

Here is the Dot Plot from one year ago - September 2021 - showing each FOMC member’s forecast (or dot).

Note that ALL FOMC members projected the federal funds rate to be less than 1% in 2022 and most expected the rate to be under 0.5%!

And the median for 2023 was around 2%.

One year later in September 2022, their forecasts are dramatically different.

The end-of-year forecast for 2022 changed to over 4%. And, the forecast for 2023 changed to over 4.5%.

This is a HUGE miss for the most accomplished bankers and economists of the day.

What do we make of this?

First, it is very hard to forecast. Even those who have access to the best information and the brightest minds find this task quite challenging. Don’t put too much weight behind short-term forecasts.

Second, the market doesn’t like surprises. 2020 has certainly demonstrated this with equity markets down over 20% and fixed income markets down about 20% as well.

Third, you have to accept that there will be surprises. That is just the way markets have been and will be. Markets are very complex and dynamic.

Fourth, we tend to focus on negative surprises and not positive surprises. These happen too! Over the long term, markets have gone up so the negatives are clearly outweighed by the positives.

Fifth, there are numerous reports about the cost of missing the best days in the market (see this video from Dimensional Fund Advisors). Don’t miss them. Stay invested if you can.

Sixth, have a plan and stick with it. Your plan should contemplate market ups and downs. If you can’t handle them, then you have the wrong plan. If you need help with a plan, contact us!

Sources:

https://www.cfr.org/backgrounder/what-us-federal-reserve

https://www.federalreserve.gov/monetarypolicy/fomc.htm

https://fred.stlouisfed.org/series/FEDFUNDS#

https://www.xtb.com/en/market-analysis/fomc-dot-plot-from-the-september-2021-meeting