Creating Liquidity in Retirement Using Your HSA

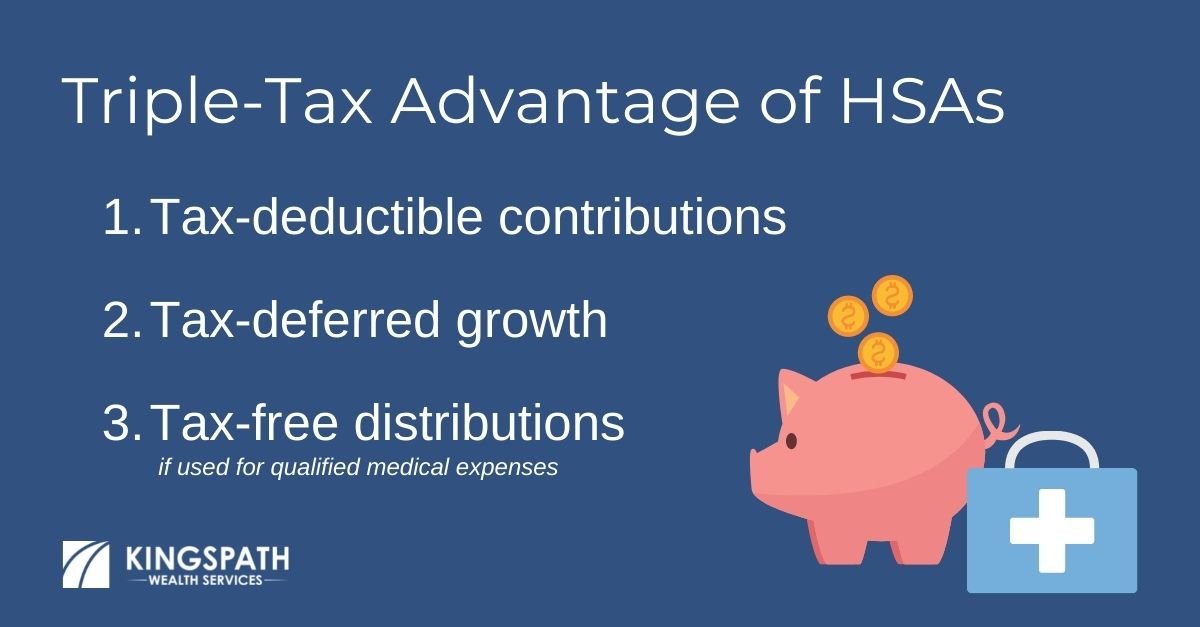

In July we wrote a blog outlining how Health Savings Accounts (HSAs) operate and some of their advantages. The most prominent advantage is their tax-advantaged nature. HSAs offer a tax deduction when contributions are made, tax-deferred growth, and potential tax-free distributions.

Despite their tax-advantaged qualities, we often find HSAs being used as a “current” source of funds for medical expenses. Typically, we would prefer to see these accounts being utilized as an investment tool for those investors who have a longer time horizon. Since no other account type exists that offers the three tax-advantaged qualities in one, we believe it is a fantastic option for wealth building.

Distribution Efficiencies

Because HSAs can make tax-free distributions (for qualified expenses), they inherently carry the potential to assist with efficient decumulation/distribution strategies within an investor’s retirement years. If allowed to accumulate and grow, an HSA can serve as an additional bucket (e.g. taxable, tax-deferred, and Roth) to leverage when contemplating tax optimization opportunities such as:

Roth conversions,

Timing of Social Security benefits,

Making qualified charitable distributions,

Harvesting medical premium assistance tax credits (pre-Medicare),

Seeking to avoid unnecessary IRMAA premium increases, and more.

Because of these variables, asset location is very important when seeking to meet specific retirement goals and manage year-by-year tax liabilities. Qualified plans and individual retirement accounts are great tools for building wealth as well. But an overconcentration of one type of account (e.g. tax-deferred) can lead to inefficiencies and a lack of flexibility for living expenses and those lumpier spending goals.

Unique Quality of HSAs: Reimbursement

Triple-Tax Advantage

As mentioned above, HSA contributions receive a tax-deduction, grow tax-deferred and, if distributed for qualified medical expenses, can come out tax-free. However, that “if” can be a limiting factor to the overall effectiveness of those assets. Once the account holder reaches the age of 65, those assets can be distributed penalty-free for any purpose. But if taken out for non-qualified expenses, they are subject to ordinary income taxes (essentially the same as distributing assets from a traditional IRA). Although the initial tax-deduction and tax-deferred growth are nice to have, it is the combination of all three that gets us excited!

Reimbursement Opportunity

To combat the potential limitations of only getting tax-free distributions for qualified expenses, HSAs carry another unique characteristic that can assist with portfolio decumulation efficiencies – reimbursement opportunity. Many qualified medical expenses don’t have to be paid for by the HSA in the year the expense was made. In fact, if you maintain your receipts (proof that it is a qualified expense), you can take distributions for those previous expenses, even 40+ years later, so long as you had an HSA account established prior to the event that warranted the expense in the first place.

Maintaining Liquidity

Initially, this feature may not sound like a big deal, but it has the potential to provide a significant level of tax-free liquidity when needed.

It’s important to note that by saving receipts you are able to maintain the liquidity you theoretically gave up while paying for those expenses out of pocket (using taxable dollars). By doing so, you get to harvest tax-advantaged growth and have the increased potential to leverage other tax planning strategies during your life.

Who Can Benefit?

Let’s say a 45-year-old who has a high deductible plan through her employer decides to utilize the HSA. She makes the full family contribution of $7,200 for the next 20 years of her career. She doesn’t touch the HSA assets for current medical expenses and pays those out of pocket (but remember, she keeps her receipts!).

At a 7% rate of return, her HSA would more than double in size relative to the amount of contributions she put in over those 20 years, reaching ~$316,000 in total value.

Of course, she can now use these assets tax-free for any future qualified expenses. But because she saved her receipts, she can also distribute these assets at any point in time to claim against past expenses that were made after she set up the HSA. If her family spent $5,000 for qualified expenses per year over those 20 years, she now has the flexibility to pull out $100,000 from the HSA whenever she needs. It’s because of this feature that an HSA can be a great source of liquidity and assistance with tax planning during the decumulation phase of an investor’s life.

If an HSA can grow to $316,000 in 20 years, the number jumps up dramatically as more contributions and time are provided for the account to grow. A family making contributions for 35 years could result in an HSA account worth over $1,000,000 (same 7% return). This would harken the increased importance to save receipts so that a good chunk of those assets could be used for tax-free distributions.

Personalized Planning

It’s important to utilize an HSA within the context of your specific situation and overall needs. Growing these assets versus using them is dependent on where you are at in your stage of life and the other assets you have in your portfolio. Here are some items to consider as you think about how an HSA may fit in your overall accumulation and decumulation strategies.

Keep your medical receipts. They may be able to provide a significant level of liquidity when it is most needed.

Consider setting up an HSA (if available) in the near future (even if you go back to a low-deductible plan) so you can build up qualified expenses that can later be used for distribution after you’ve enjoyed the benefit of tax-free growth.

Consider making Roth contributions to company plans or IRAs instead if you anticipate a large HSA balance that may not be fully utilized towards qualified expenses.

If you have a long-time horizon, consider avoiding the use of your HSA for current medical expenses. Let these grow and work for you over time!

If you are later in life, you may want to begin using the HSA assets when you can, since these are not very tax-efficient if passed to the next generation.

If you need assistance strategizing around how an HSA may fit in your overall portfolio, anyone on our team would be happy to have that conversation.