What’s the Fastest Growing Charity? Donor-Advised Funds!

What is a Donor-Advised Fund?

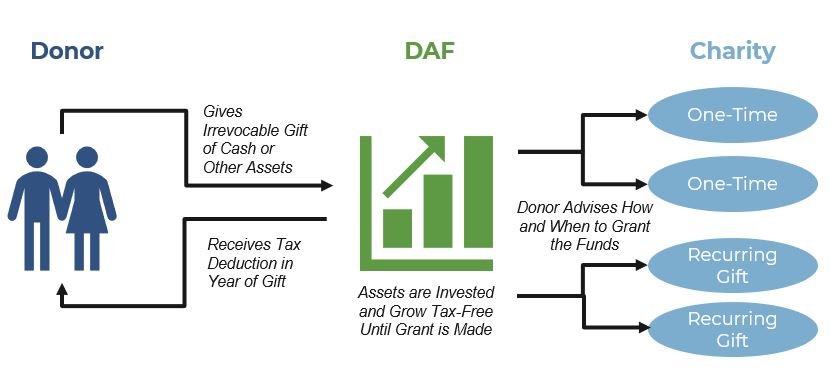

In recent years, the growth of donor-advised funds has been outpacing the growth of all other giving vehicles, including private foundations, charitable trusts, and overall giving. If you’re unfamiliar with donor-advised funds, or DAFs, these are 501(c)3 philanthropic vehicles designed to simplify charitable giving; allowing donors to stage out their giving while also optimizing their charitable deductions.

Case Study 1: Reducing Income in a High-Income Year

Let’s say a donor is experiencing a particularly successful year of business and expects an end-of-the-year bonus of $100,000, well above her normal level of $20,000. She has been committed to giving 50% of her bonus each year but won’t have time to think about where to give, yet would like the deduction against her income in the current year. What does she do?

At this point, the donor has a few options:

She can wait and give in the next year when she has had time to think about where to give and how much to give;

She can scramble and give to organizations without thinking deeply about what is important and why; or

She can give $50,000 (her 50% commitment) in the current year to a DAF and take the full deduction of that amount in itemizing her taxes. Then in the future, she can direct that giving to the charities she cares about using her DAF account.

From a tax perspective, option 1 is the least efficient; she pays full income taxes this year, and may not be able to use all the deductions in the following year. She realizes the most income tax deduction benefit with options 2 and 3. But with option 3, she can maximize the tax benefit and, potentially, the joy of generosity. There are no rules or regulations about how quickly the DAF funds must be distributed, so the donor can feel free to space out her giving as she sees fit. To do so, she simply logs on to her DAF account, identifies her favorite charities, hits click, and the money is sent. No checks to write. No receipts to keep. Simple.

Case Study 2: Gifting Appreciated Assets to Avoid Long-Term Gains

Additionally, the tax benefits are further enhanced if a donor gives appreciated assets to the DAF. Imagine a donor holds 300 shares of stock with a current market value of $50,000, which he purchased 2 years ago at $100 per share.

Option 1: He could sell the 300 shares of stock, realize $20,000 in long-term gains, set aside funds for the taxes due, and then donate the remaining proceeds.

Option 2: He could donate the 300 shares of stock worth $50,000 directly to the DAF and never realize the $20,000 in long-term gains. See the two options and the taxes due/saved outlined below:

Other Benefits

These tax benefits are not restricted to only appreciated stock. Donors can typically donate other more complex investments to DAFs as well, including real estate property, mineral rights, closely held company stock, or other illiquid investments. The key is that if the investment has appreciated in value, you will not realize capital gains if you donate the investment.DAFs can also provide anonymity for donors. Once the funds have been given to the DAF, they legally belong to the DAF and not the donor. When funds are disbursed from the DAF, the donor has the option to appear on the check or not.

Concerns About DAFs

There have been concerns regarding DAFs in recent years, as many of the largest entities running DAFs are financial management firms that reap management fees from DAF accounts. Additionally, since there is no annual distribution requirement for DAFs, many donors allow their DAFs to grow instead of disbursing the funds to charities. Some donors may view DAFs as charitable assets in which they have a continuing interest and want to pass the accounts on to the next generation. This sense of ownership in the DAF encourages donors to hoard the funds rather than distribute them. Donors may feel charitable (and will certainly realize the tax benefits of their actions) but should be aware that real charitable impact is made when funds are granted from the DAF to the charities that need them.

Resources

At KPP we continue to think DAFs are a great resource for both annual and long-term planning around taxes and giving. You may be able to give more to the charities you care about. If you’re interested in opening a DAF, there are community foundations, such as the Greater Houston Community Foundation; faith-based organizations, such as the National Christian Foundation or the Jewish National Fund; or large national platforms, such as Fidelity Charitable, Schwab Charitable, or Vanguard Charitable. If you have any questions, please feel free to reach out to us at info@kingspathpartners.com. Printable Donor Advised Funds