The American Rescue Plan

How will the third round of stimulus affect you?

The American Rescue Plan

In recent weeks if you have been watching the news, own a smartphone, or had a conversation with another American, there is a good chance that you know about the third round of stimulus checks (or direct deposits) coming from Washington in the American Rescue Plan.

These payments have already begun to make their way to Americans since President Biden passed the plan on March 11. For many, the passing of this bill will result in payments of $1,400 per dependent with additional benefits added to the already significant child tax credit (amongst other provisions).

An Overview of the Plan

If you have already received the $1,400 payments per individual within your household, then your reading can likely stop here!

However, if you received less than the full amount or less than you were expecting you may want to dive a little deeper into the IRS’s checkpoints and how you might be able to capture the full amount. Please take this opportunity to skip to the Conclusion for some AGI reduction ideas or to find out if you qualify.

Keep reading for details on how your income and the stimulus could impact you, particularly if you have a family and an income in the $150,000 range. Please consider yourself warned as this may get a little complex (Would we really expect anything less from our government and the IRS?).

The Details

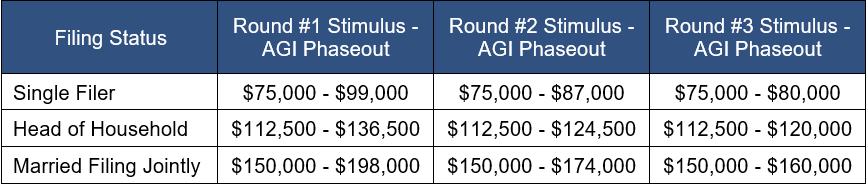

Unlike the first two stimulus payments, the phase-out of third-round rebates is significantly more aggressive than before (see table). In some cases, this could cause a family’s “marginal tax rate” to be greater than 100% (That was not a typo!). Within this blog, we outline how a $10,000 bonus in 2021 could end up costing a family more than $10,000 in taxes and “lost” tax credits.

An important note to make is that the stimulus payments will not be clawed back. Meaning, that if you receive stimulus money because you qualify through an earlier checkpoint, you will not have to pay the IRS any money back if you “do not qualify” at proceeding checkpoints.

Understanding Checkpoints #1 - #3

Checkpoint #1 - We are currently amid the first checkpoint with the IRS evaluating the most recent tax return you have submitted (2019 or 2020). If your AGI is below the lower threshold you will receive the rebate in full. If you are in between the lower and upper thresholds you will receive a pro-rated amount across you and your dependents.

Checkpoint #2 – If you had gone through Checkpoint #1 without filing your 2020 taxes and had not received the rebate or only a partial amount, the IRS will review your 2020 AGI to evaluate if you qualified for an additional portion or the whole stimulus payment. Keep in mind, to qualify for the rebate at this checkpoint you must file your 2020 taxes prior to September 1, 2021, or 90 days post the 2020 filing deadline (whichever comes first).

Checkpoint #3 – The final checkpoint comes with the filing of 2021 taxes. This checkpoint is only applicable to individuals and families who have not yet received the full stimulus payment. If their AGI level is lower than the prior two checkpoints, they will receive an additional balance that will be applied to their tax liability (or lack thereof). This is the last opportunity to receive stimulus.

AGI Awareness: Why Do These Cut-Offs Matter So Much?

Let’s use a family of five as an example. Assuming the family did not qualify for the stimulus based on 2019 or 2020 income (thereby not receiving a stimulus payment in the first two checkpoints), a potential 2021 income between the $150,000-$160,000 thresholds poses significant financial implications.

If their 2021 AGI is $150,000 they will receive the full $7,000 (5 x $1,4000) of stimulus payments. However, if their expected AGI is $155,000 (because of a $5,000 bonus), they will lose out on half of the stimulus and only receive $3,500. And of course, their rebate would go to $0 if that bonus is $10,000 (pushing them to $160,000).

This means that 70 cents of each dollar of additional AGI above $150,000 (up to $160,000) would be lost in stimulus payments and additional cents on each dollar could be eaten up by federal income tax, capital gains tax, and FICA taxes. At the 22% federal income marginal tax bracket, a $10,000 bonus could essentially be worthless to the family. The table below outlines a net $35 difference between a family with an AGI of $150,000 and $160,000.

If you find yourself on the fringe of losing benefits, all hope is not lost! As mentioned earlier, we list some AGI reduction ideas in the Conclusion.

Child Tax Credit

The American Rescue Plan also has large implications for those with children. The already generous $2,000 child tax credit is being pushed up to $3,000 and $3,600 for children under the age of 6. The credits have also been made fully refundable. However, the $150,000 AGI phaseout for filing jointly is vital here, as the credit above $2,000 (per child) is subject to stricter phase-outs.

The additional layer of tax credits is reduced by $50 per $1,000 of AGI above $150,000. Having more children that qualify for this credit results in a higher upper threshold.

There will be an option beginning in July to take 50% of these credits in equal monthly payments through the last 6 months of the year, with the remaining 50% coming to you at tax filing. It may be wise to exercise caution as some of these benefits could be clawed back (unlike the stimulus payments) should AGI phase-out limits be exceeded.

Revisiting the family of five above, we can see that the $10,000 bonus in 2021 could result in a >100% “marginal tax rate.”

From this example, the $10,000 bonus could cost the family $465 in reduced stimulus, tax credits, and increased taxes!

Conclusion: You Have Time to Think Strategically

Of course, there are many other implications to this 242-page bill, but the focus for most families and individuals will be around the key AGI cut-offs (which includes some that have not been mentioned here).

Thankfully because this bill was signed in March, individuals and families have time to think strategically around ways to reduce and or limit their AGI in 2021 (and potentially 2020). We provide some ideas here if you find yourself at or near some of the applicable limits. These include:

Contributing to a health savings account or flexible spending account,

Contributing to pre-tax retirement plans (2021 may be a good year to pause on Roths),

Deferring your bonus or other forms of compensation (if that flexibility exists),

Frontloading business expenses,

Utilizing munis to provide tax-free interest income in taxable investment accounts (note - this does not increase AGI but can affect MAGI),

Giving appreciated securities to charity rather than cash to limit realized capital gains in taxable investment accounts, and

Giving away your RMDs using qualified charitable distributions.

If you need help strategically thinking through your financial situation, please reach out to any of our team members at Kings Path.